When is a Battery Energy Storage System viable for a Victorian business?

Batteries are the talk of town these days. They are a cornerstone in the green energy revolution that is spreading around the world. More importantly, they fill a gap in balancing electrical consumption with supply. But they are expensive.

A high price of batteries is the reality facing most Commercial and Industrial (C&I) companies. Unfortunately for Victorians, a recent study by New Energy Ventures (NEV) found that our state is the least attractive location for acquiring a battery system.

Despite the findings, batteries can still provide a significant return on investment for companies in both regional and urban Victoria. However, the business case will only break even under certain conditions. We need to take a closer look at our electrical consumption profile, the quality of the supply and the value of batteries.

Battery trends in Australia

Currently, lithium-ion is the most mature technology for the energy storage needs of our electricity network. It is able to store more energy per unit and performs better at any state of charge than other chemistries. Over 70,000 home batteries have been deployed throughout Australia, many connected into Virtual Power Plants (VPP), a sophisticated form of aggregation that makes the many small parts appear as a giant distributed battery to the electricity network.

Very large batteries are used around the edges of electricity networks and are proliferating around the world. These systems are very powerful with huge storage capacity to buffer energy and overcome supply troughs in the grid. And the scale keeps growing, the world record now belongs to a project underway in Moss Landing, California, with 1.5GW power capacity and 6GWh storage. That’s more powerful than the Loy Yang power station in Victoria, and over 30 times more storage than the upgraded Big Tesla Battery in South Australia.

Commercial & Industrial batteries

While home and grid-scale battery systems are on a roll, the picture is quite different in the Commercial and Industrial (C&I) space. For C&I batteries, this is likely due to the more complex uses of a battery, the so-called ‘value stack’. The basics to this value stack are as follows:

- Most businesses have fairly consistent consumption profiles over time, but there will be a small number of peak demand events that batteries are good at managing.

- By managing peak demand, businesses can reduce their demand charges. These charges are paid in addition to usage charges on their energy bill.

- Battery Systems can be exposed to market prices and additional value can be captured by providing services to the grid (FCAS) and buying and selling on the electricity market (price arbitrage)

- While battery costs are still high for C&I batteries, building a viable value stream is actually a more important consideration than the upfront capital cost.

These four factors – consumption profile, demand charge, market prices and system cost – were studied by NEV across 14 networks and 28 different tariffs for five typical consumption profiles. They even considered a basic and a more advanced battery function that could directly participate in the spot price and frequency (FCAS) markets. After NEV crunched the numbers, the result was clear:

“West Queensland is the ideal location for a battery system, in all cases. Victoria the worst.”

The main reason for this is that the tariff structure in Victoria is different: demand charges are locked in for a year instead of monthly in other jurisdictions. FCAS prices are also lower, and the electricity spot prices are less volatile, which means that there is a smaller spread between buying and selling opportunities. Lastly, the Victorian networks have been subject to fewer upgrades which have kept prices relatively low, but implicitly with less cost to offset.

The case for reliability in regional areas

In regional areas, electricity supply can be unreliable due to high impedance faults and voltage sags. A lot of industrial equipment such as boilers are very sensitive to power fluctuations and a shutdown is a complicated and costly event. In food industries, Combined Heat & Power (CHP) systems are very popular for their versatile output. However, their electricity supply is variable, and they are subject to regular maintenance, which again is costly to the business. Many companies that operate around the clock can incur costs in the order of hundreds of thousands of dollars a day for outages and power fluctuations.

Batteries can take that variability and cost out of the equation and smooth out the voltage.

Last year, Freedom Foods acquired a 500 kW/1250 kWh battery system to store energy from a large co-located solar array. Many other companies in regional areas are likely to follow in their footsteps. Anecdotal evidence suggests that a battery investment can pay for itself many times over in the first few years.

There is a definite case for batteries in regional Victoria. Unfortunately, their capacity is generally limited to a few hours, not many hours or a day, which still makes a diesel genset a necessity.

Value stacks for urban areas

So, what happens if you have a business in an urban area? Thanks to the many interconnections and multiple supply points, urban networks are generally graced with high reliability and excellent power quality. That said, we asked NEV to consider a range of further options and scenarios to determine what situations might work for batteries in urban areas.

In short, there is still a case for batteries.

Thanks to NEV modelling of Victorian networks and consumption profiles, we can set a price on the internal value required of a battery to be financially viable. This means that the battery needs to perform for the business, i.e., behind-the-meter, to the order of a particular dollar value. Once we know that value, we can look at the other value streams and conclude on the business case.

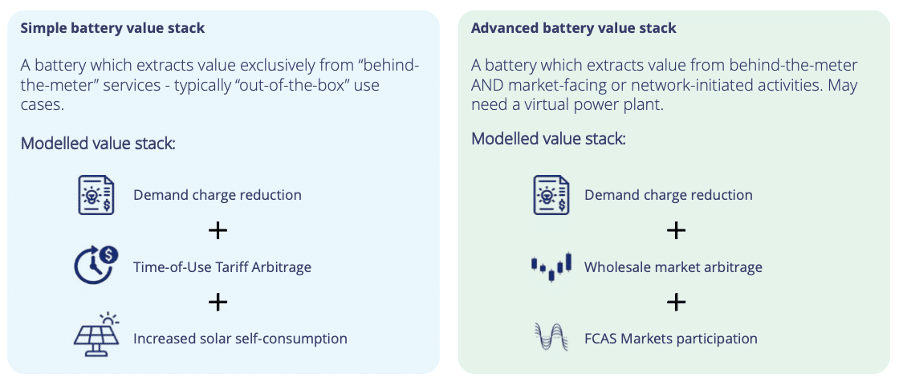

NEV defines two types of value streams, the simple and the advanced. The simple value stream is about “out-of-the-box” use cases: reduced demand charges through solar supply and shifting consumption to mid-day times.

The advanced value stream adds participation in the electricity wholesale and frequency regulation markets, if the network has capacity for you to export. While more sophisticated, it largely relies on a tighter relationship with an electricity retailer that is a ‘market participant’ with a license to help the network stabilise the electrical frequency of 50Hz.

Best cases for Melbourne companies

The NEV study indicates that the best opportunities exist for

✓ Medium size businesses in the Melbourne inner suburbs (CitiPower network) and

✓ Large businesses in the eastern suburbs (United Energy network).

It is possible for such businesses to make a business case today and break even. However, only the advanced stack cases are able to achieve this at the moment.

Here is an example.

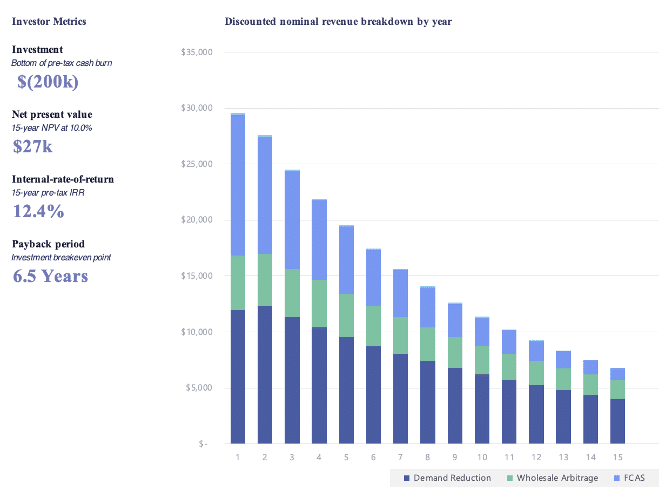

Large factory in the Eastern suburbs of Melbourne

Minimum 400MWh annual consumption, 2MW peak demand, 1MW solar array, 200kWh battery, advanced value stack.

A battery returns $27,000 after 15 years, with a 6-and-a-half-year payback period.

Note that cash flows were conservatively discounted based on current understanding of market and tariff trends. Any upside to market prices in particular would immediately improve the outcome.

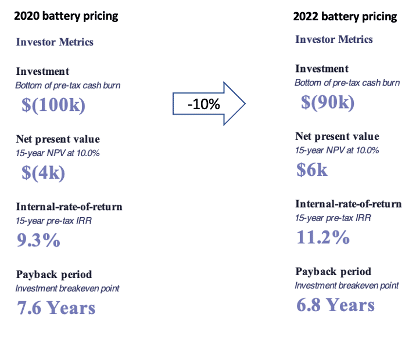

On the other hand, with falling battery prices, an unviable case may break even in just two years. NEV’s estimate is that battery prices will fall by 10% from 2020 to 2022. Here is an example.

Medium shopping centre in the inner suburbs of Melbourne

Minimum 60MWh annual consumption, 2MW peak demand, 1MW solar array, 100kWh battery, advanced value stack.

The 15-year net present value (NPV) that was negative in 2020 would become positive two years later.

Another way to look at it is the value of a battery to the business beyond energy financials. In the example above, if business losses due to downtime reduced by $10,000, the battery would have returned a positive NPV in 2020.

As a result, many companies today explore trading on the spot market and providing network support, even though it goes well beyond business-as-usual. And this can be very profitable: The Big Tesla Battery in Hornsdale, South Australia reported $3.4 million in profit in just one month (September 2019), from spot market trading and frequency control.

Solar self-consumption comes first

Across all geographies, the first thing to consider before installing batteries is to consume solar energy as it is produced on your rooftops, and to export as little as possible.

Solar panels are so cheap these days – even good quality ones, it’s a no-brainer. Maximise the use of your roofs by installing panels. A popular option is to cover car parks with panels, both for employees’ comfort and for extra solar potential.

As always, before investing in energy generation, see what can be done to make the installation more energy efficient. An energy audit is a very small cost for the savings it can bring. Having reduced your consumption, seek to match energy production with your consumption profile. This is where shifting loads to periods of high solar exposure pays great dividends: that energy is virtually free.

Where to from here?

Here’s a checklist for you:

☐ Undertake an energy audit of your facilities and investigate any opportunity to reduce your consumption.

☐ Install solar panels on roofs and carpark covers to match as much as possible your electrical consumption to locally produced energy. You may also be able to export any excess, depending on the network’s capacity.

☐ Look for peaks in your electricity consumption on a typical day and see if any equipment can be operated at another time of the day, preferably during high solar exposure periods when the electricity price is low.

☐ Calculate the value that a battery would bring to your business by the downtime costs it would save or other benefits, and the reduction in your demand charges.

☐ If the network allows for it, explore with your retailer the possibility to add income streams from participating in the electricity markets.

☐ Keep abreast of battery chemistry and pricing developments in the industry. This is a very fast-moving technology space, and we are yet to see the most amazing innovations.

Last, but not least:

☐ Engage an energy consultant specialised in battery systems and who can model your energy consumption and supply. Unlike solar, where nearly every sun-soaked roof presents a viable solar project, batteries opportunities are much more hit and miss. Engaging a consultant early will save you a lot of time and effort and is the best way to find the options that makes the most sense for your business.

Emphasising the importance of the final point, in the absence of a modelling exercise and professional advice, many companies are presented with proposals from equipment and service suppliers without a proper decision-making framework. The risk of avoiding professional advice is higher costs and lower value than hoped for, or than possible.

In conclusion

To quote Stephen Sproul of Hitachi ABB Power Grids:

“Most of our C&I customers are installing for reliability first and foremost, and then peak demand reduction and solar self-consumption are other benefits.”

That’s most likely the starting block of a battery project today but the market is rapidly changing. If the energy supply to your business is costly or simply complicated, it is worth a deeper dive – and professional advice is highly recommended. For many, it has strengthened the business and prepared them for the future. And the future is coming very quickly, as battery chemistry innovations proliferate. You certainly don’t need to be on the bleeding edge of technology, but the leading edge is good place to be.

Special thanks to James Allston and Michael Jurasovic of New Energy Ventures for their support in writing this article.

This article was written by Chris Wallin – Chris is an experienced business professional and project manager in technical and commercial areas. As an electrical engineer, he worked on large industrial installations from design to project handover. He also had a career in business management with Information Technology companies, and regularly volunteers with community energy organisations.